Rising Healthcare Costs—What Health Plans Need to Know Now (and in the Year Ahead)

The respected accounting and auditing firm PwC has released a new report titled “Medical Cost Trend: Behind the Numbers 2025.” It contains valuable forecasts for

In late April 2022, CMS announced the changes to the Medicare Advantage (MA) program for 2023, and the implications for health care organizations submitting provider networks for approval for plan year 2024 are major, to say the least. If, like most, your organization finds itself scrambling to complete your network build before the June submission deadline, you’re not going to be thrilled. Timelines got a lot tighter.

“

Gone are the days when you could submit renewal or expansion applications in February knowing you had more than three months to contract providers for formal submissions of bids in early June.

”

To ensure that Medicare beneficiaries have sufficient access to care, “CMS is requiring that MA applicants demonstrate they have a sufficient network of contracted providers to care for beneficiaries before CMS will approve an application for a new or expanded MA contract.” Gone are the days when you could submit renewal or expansion applications in February knowing you had more than three months to contract providers for formal submissions of bids in early June. Starting with CY 2024, you have to apply and submit provider networks at the same time–in February. The silver lining, albeit a small one, is that CMS will accept letters of intent (LOIs) from providers in lieu of signed contracts, giving you extra time (until the end of 2023) to get provider and facility contracts signed.

If you’re just finishing your CY 2023 MA networks (as is probably the case), you’ve got just over eight months to get your CY 2024 networks built.

As in eight months to:

Make your go/no go decisions

Recruit providers and facilities

Get LOIs signed

You might think that means you’ve got to cancel your vacation plans, but there are some options you may not have considered

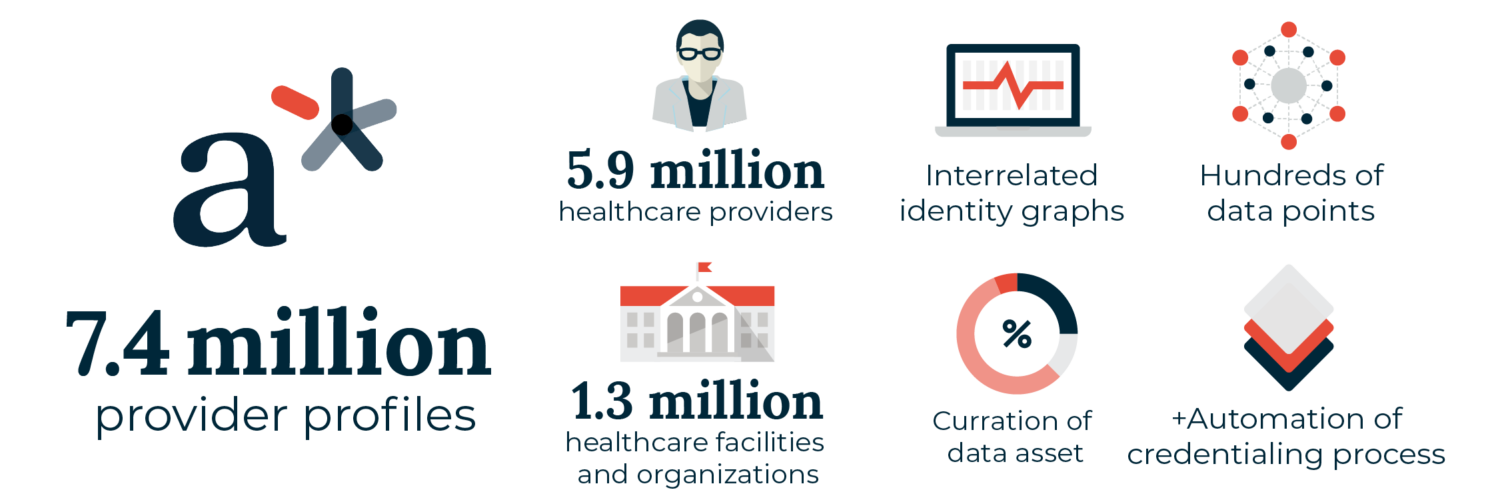

andros scales up your team’s capacity to build compliant provider networks in new markets—while reducing your administrative costs—using our optimized process and powerful technology. Drawing on the 7.4 million provider profiles in the a* Platform, the healthcare industry’s largest provider database, andros can help you quickly assess markets for initial build and expansion networks, then leverage our fastest-path-to-adequacy network modeling approach to allow you to make quick decisions on whether you can build your network to adequacy. That way you retain strategic flexibility to either build or pivot, reducing the risk of wasted time and resources.

“

Leverage andros to recruit providers and get signed LOIs for your CY 2024

”

The one area where this rule change benefits health plans building MA networks is the extended window of time for contracting. If you have the capacity to assess

markets and build the MA networks you’re targeting for CY 2024 in-house, you’re actually in great shape–because most of the competition will be scrambling. One way to make sure you maintain and build on that advantage is by leveraging andros capabilities to contract and credential networks. Make your submission in February 2023 with signed LOIs, knowing that andros can use its workflow- optimized recruiting process to deliver signed contracts for credentialed providers (and facilities) in time for CY 2024.

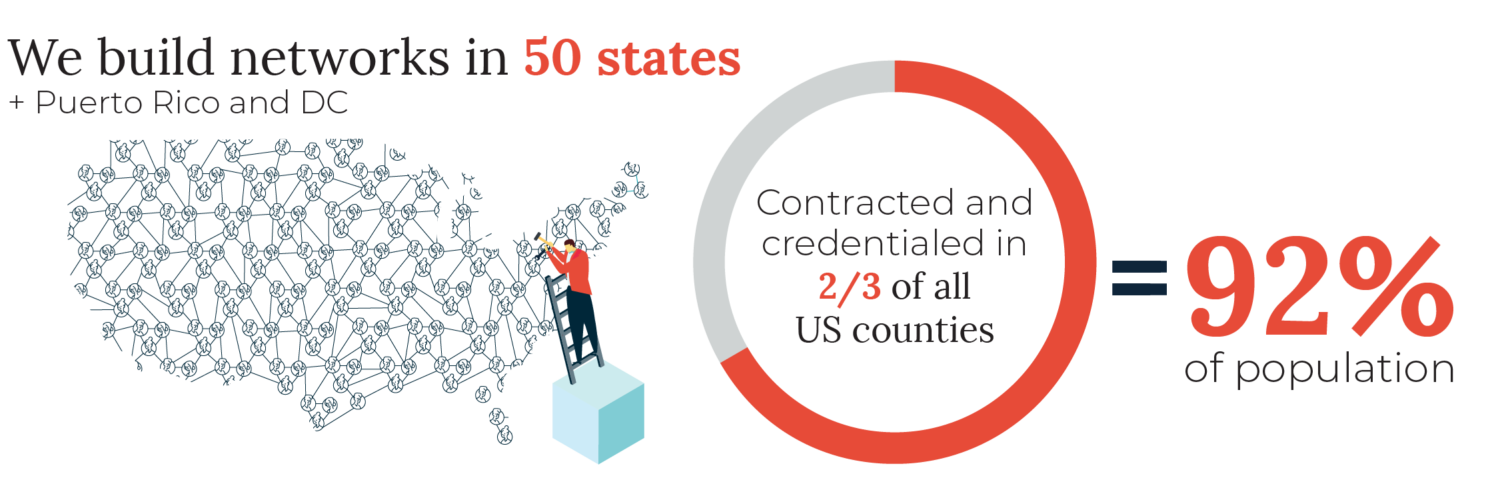

With experience building and credentialing networks in all 50 states and in 67% of counties containing 92% of the population of the US, andros has the technology, experience, and scale to ensure you handle the rapid transition to CY 2024 MA builds smoothly and successfully.

The respected accounting and auditing firm PwC has released a new report titled “Medical Cost Trend: Behind the Numbers 2025.” It contains valuable forecasts for

Recently Andros came together for a powerful in-person company-wide event called Ignite. I’m thrilled to share some of the many highlights and to celebrate the

Offering comprehensive, end-to-end healthcare provider network management services, including recruitment and contracting, credentialing, and provider data management.