No one starts a Medicare Advantage (MA) network development project with the idea of pulling the plug before it’s approved by CMS. With the continued growth of Medicare Advantage, abandoning a build that’s in-progress could easily feel like a fruitless exercise. But that doesn’t have to be the case. Health Plans, and specifically their network development teams, can often learn critical lessons–and profit from them–if the decision to abandon an MA network comes early in the process.

What distinguishes a successful lesson learned from a fiasco? It has a lot to do with your approach to network development. We’ll walk through the early stages of the process and examine where and how you can turn a “no go” decision into a positive.

The first stage of a Medicare Advantage network build is determining which market(s) to target. A thorough market assessment encompasses several different determinations:

- Overall population as well as the size of the Medicare-eligible population

- Existing health infrastructure

- Where primary and specialty providers exist in the market

- How the geography of the market relates to MA adequacy requirements

- Competitive market data, including information on health systems in the market

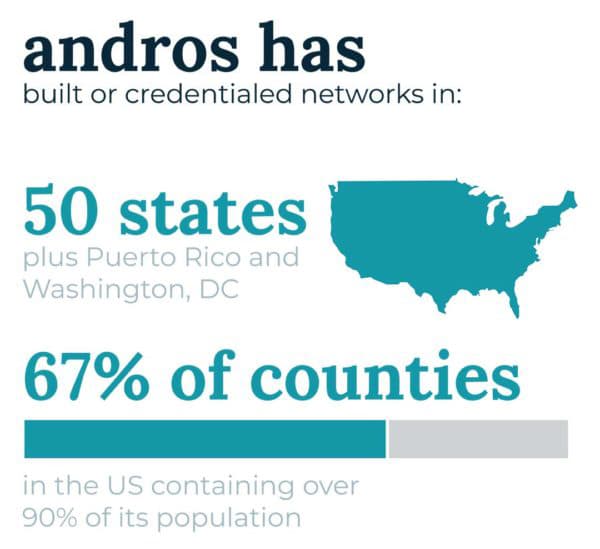

Because the investment in the network build is low at this stage, organizations may be inclined to make decisions without gathering or analyzing relevant data. They may start up a project without understanding conditions that may predispose them to failure, for example, a mission-critical health system that has decided not to partner with any additional health plans. Especially when considering moving into new territories, partnering with an organization that has geographical expertise and market knowledge can give organizations the confidence to pass on opportunities that are at higher risk of failure than they initially appear or might just be too expensive to build successfully.

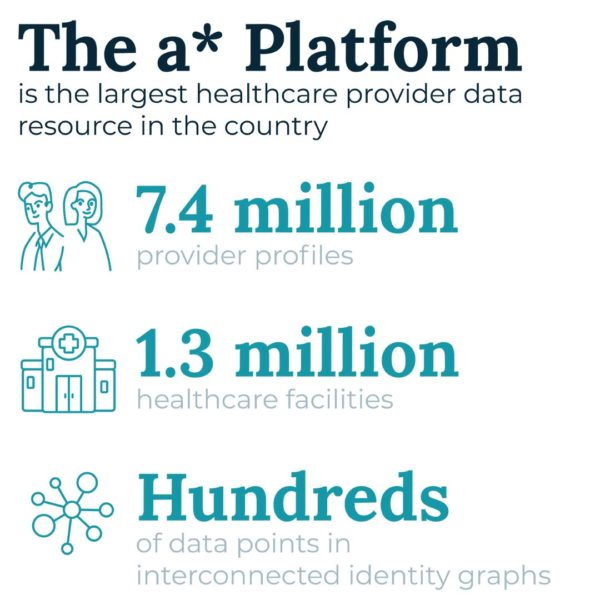

Once an organization makes the decision to build an MA network in a market, they must identify and target the providers and facilities necessary to reach CMS adequacy standards. Extensive, accurate provider data is the key to success in this task.

The first step is identifying healthcare providers that meet CMS’ adequacy requirement. This includes time and distance rules per market, provider types, and quantities of facilities required for each market type. Then, more importantly, health plans must determine which providers to target for recruiting efforts. Strategic targeting decisions must account for factors like:

- If there are limited healthcare facilities or provider groups in a market, which if any must be contracted to ensure adequacy?

- If there are limited specialists of one or more types, does the network have to nail down their participation to meet adequacy?

With answers to these questions, health plans have another opportunity to assess their likelihood of success prior to having spent significant time or money on the network build. If they know a certain specialist or facility is necessary to meet adequacy, they can target that provider or facility right away, knowing that failure to close may put that market at risk of not achieving adequacy. Alternatively, digging into the data may reveal that a network built in a neighboring geography would be more likely to succeed, allowing the organization to pivot.

These targeting decisions translate into priorities for network recruiters on what andros terms the fastest path to adequacy. androsCompass*, our technology solution for network development projects including Medicare Advantage, manages outreach by recruiters to providers, including those prioritized because they make larger contributions to reaching adequacy first. Recruiters then use cost-effective multi-channel approaches to reach these providers and close contracts efficiently.

As provider contracts close, an MA network’s needs for additional providers in a given specialty or geography changes. The health plan can recalculate a new fastest path to adequacy, conserving resources in its pursuit of that goal. As more and more contracts come in, patterns can emerge that may prompt the health plan to expand, refine, or otherwise change the network build it is pursuing.

Medicare Advantage network builds are long-term projects that have the potential to significantly impact a healthcare organization’s bottom line. But finding out early on that they may be going off course doesn’t have to equate to failure. It may very well provide the type of insight necessary to achieve sustained success.